Throughout history, financial markets experienced numerous ups and downs, trials and tribulations. It would be wonderful if we never had to witness or worry about recessions, but history shows this is the natural cycle of the economy. As the old saying goes, what goes up must come down!

At the moment, there are whispers of an impending recession in Canada, perhaps even a depression, along with other parts of the world. The definition of a recession is an economy that is experiencing a reduction in spending, decline in the output of goods and services, high unemployment, and lower consumer consumption. Further, a depression is a more severe and prolonged recession. A recession has not been formally announced in Canada, but many individuals, businesses and entities express financial strain. Observing the history of financial crises in Canada can help people navigate the current economic landscape. “Those who do not learn from history are doomed to repeat it,” Karl Marx stated infamously.

With the 2024 year ahead of us, we can all learn something from a history of financial crises and use it to weather the economic strain Canada is currently feeling. Keep reading to learn more!

Table of contents

A History of Financial Crises in Canada

Like many other places in the world, Canada has had their fair share of economic downturns. Since 1939, which was the ending of the Great Depression, there have been 12 recessions in total. Five of these occurred after 1970, meaning that Canada’s economy has been pretty stable over the last 50 years. As mentioned, what goes up must come down. It’s the natural ebb and flow of the economy.

Let’s take a closer look at the most recent 5 recessions below, in chronological order:

START WORKING WITH A WEALTH MANAGER NOW

- October 1974 to March 1975 – In the mid-70s after the Yom Kippur War, oil prices changed drastically. To respond to the issue, the Bank of Canada injected more dollars into the economy. This led to a stagflation in the economy and prices rose, causing a recession. Some experts believe a similar phenomenon of stagflation is occurring again in the present day. As we said, history tends to repeats itself!

- June 1981 to October 1982 – The recession of the early 80s is widely considered to be the most severe economic recession since World War II, until the 2008 Financial Crisis. During this time, there were changes to monetary and economic policy. These issues exacerbated by the energy crisis of the late 70s. Oil prices rapidly increased as a result which rippled through the economy, causing a financial crisis.

- March 1990 to May 1992 – This was one of the longer recessions in Canada as it lasted two years. Similar to present day, Canada experienced inflationary pressure in the early 90s. As a result, the Bank of Canada increased the prime rate to slow inflation, which caused a recession and job loss on mass.

- October 2008 to May 2009 – During the late 2000s, the United States experienced the Financial Crisis which rippled through other global economies, including Canada. Often, when the US has a recession, Canada is impacted too because the economies are interlinked. This recession occurred because US banks were over issuing mortgages to people who weren’t good candidates for financing. When the variable rates increased, many couldn’t afford their mortgage payment and defaulted. This led to a recession felt world wide.

- February 2020 to April 2020 – The most recent recession occurred as a result of the COVID-19 pandemic. Due to social distancing and temporary business closures, supply chain disruptions occurred, thereby causing this recession. Eventually, people adjusted to the new economic environment, thereby ending the recession.

Related Reading: Is the Longest Bull Market Over?

What was the biggest financial crisis in history?

The biggest financial crisis in North American history was the Great Depression which lasted from 1929 to 1939. A recession is much less serious than a depression. Typically a recession lasts up to a couple years, but a depression lasts much longer. Considering that the Great Depression lasted 10 years, it was a very serious financial crisis for many Canadians and others in the world.

The Great Depression primarily occurred due to the 1929 stock market crash. It crashed as a result of companies producing too many goods which led to a reduction in the prices of the goods. In other words, there was small demand and ample supply causing the economy to fall out of order. After the stock market crashed, there was a general downward spiral in the economy. Businesses went bankrupt and many Canadians lost their jobs. Since people didn’t have jobs that provided them with disposable income, more businesses went bankrupt. And the cycle went on for years until there was a resurgence in the 1940s.

Another contributing factor to the Great Depression was the involvement and attitudes of the government. At the time, many politicians and economists were “laissez-faire” which was the belief that things should just be “left alone”. The idea was that the government shouldn’t engage themselves in the economy and leave it up to capitalists to manage. However, during the Great Depression, this ideology was questioned considering the disastrous conditions of the economy.

Initially, political leaders believed that it was up to churches and local governments to provide social services in response to the Great Depression. Unfortunately, some governments went bankrupt without federal intervention. A resurgence was eventually experienced and the government became more involved in economic affairs. Prime Minister Bennett was the leader behind much of this change. He started the Bank of Canada and Canadian Wheat Board. In addition, Bennet intended to introduce minimum wage and unemployment insurance, both of which continue to exist in Canada today. This work was continued by William Lyon Mackenzie King who won the election against Bennet in 1935.

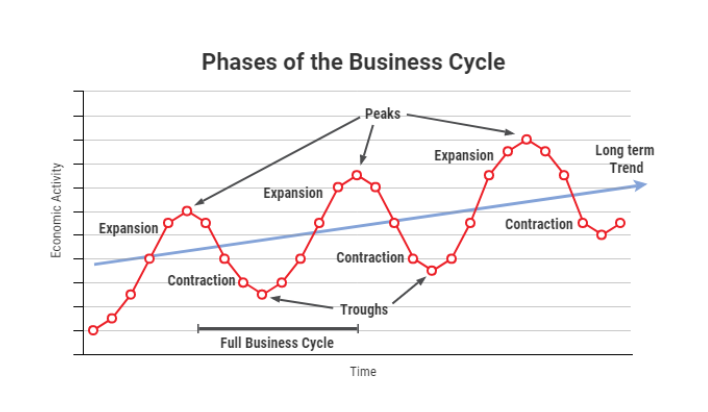

How long is the average recession in Canada?

The average recession lasts between three and nine months in Canada. In comparison, a depression would be longer than a year, typically several years. Below is a graph that demonstrates the phases of the business cycle for further detail.

Related Reading: Investment Life Cycle

Are we in a recession 2023?

As the end of 2023 just came to a close, there was no recession announced by any political or economic governing body. So no, Canada was not in a recession as of 2023.

However, many Canadians feel the effects of high inflation, rising interest rates, have experienced unemployment, and are generally struggling financially. Historically, many recessions are announced after the fact, including the most recent recession in 2020. For this reason, it is entirely possible that Canada is experiencing a recession, but the talking heads are not disclosing the nature of the issue at this time.

Will Canada go into a recession in 2024?

Heading into 2024, many Canadians feel uncertain about the economic environment and worry that things will get worse. It is likely that Canada will experience a recession in 2024 as a result of all the economic conditions. In fact, many experts predict a recession for the 2024 year in Canada. Mainly because of high interest rates and high inflation. These factors impact consumer’s spending which may affect the health of businesses. If people aren’t spending as much in 2024, some businesses might downsize or even go bankrupt thereby causing a recession.

What to do if economy collapses?

If the economy collapses, there could be some tough times ahead for Canadians. In fact, Benner Cycles predict that 2023 and 2024 will be years of “Hard Times”. This means facing unemployment and struggling to make ends meet financially.

However, these periods are ideal for purchasing stocks and other investments because the price is low. Investors can then hold onto their investments until a boom is experienced once again. The challenge here is having the capital to actually invest. Unfortunately, during tough economic times, cash is tight in households which makes it hard for people to build wealth and escape these cycles. But if you do have spare cash and the economy collapses, it’s a good time to buy up investments!

Learning from a History of Financial Crises in Canada

Ultimately, history continuously repeats itself and those who are unaware of history are destined to repeat it. This article covered the history of financial crises in Canada over the last 50 years. As you probably have realized by now, much of what happened in the past is being experienced in the present day. We hope this article helped you learn about the financial history of Canada and that you can apply it to your own financial lives!

Read More: How to Recession Proof Your Portfolio