It has been said that the stock market is akin to a roller coaster ride, with prices shifting and fluctuating. But what many don’t consider are the external factors that can affect the performance of stocks, particularly those related to world events. Interestingly, a world event that has nothing to do with money or commerce can have an outstanding impact on the stock market. Often, investors may reduce their strategy to numbers and forget to look at the bigger picture. It goes without saying that everything in our world interconnects. So the question becomes, how do world events affect the stock market?

Table of contents

In this blog post, we’ll take a look at how geopolitics and international affairs may impact share prices. As well as strategies investors can use to mitigate risk during times of uncertainty.

What are examples of world events?

In modern history, there have been several world events that dramatically impacted the global community. In many ways, these kinds of events have altered the course of humanity. Let’s take a look at a few examples of kinetic world events from the last 25 years.

In 2008, one of these pivotal moments was the Financial Crisis which caused enormous economic damages worldwide. The Financial Crisis originated on Wall Street when a series of mortgage backed securities collapsed. Caused by the faulty, sub-prime mortgages within them. While this was a financially driven event, the outcome went beyond financial markets. People in the United States were homeless and there was a bail out from the U.S. government. Plus, the Canadian, European, Asian and all other global markets felt the effects to some degree even though they had no involvement in the activities taking place on Wall Street.

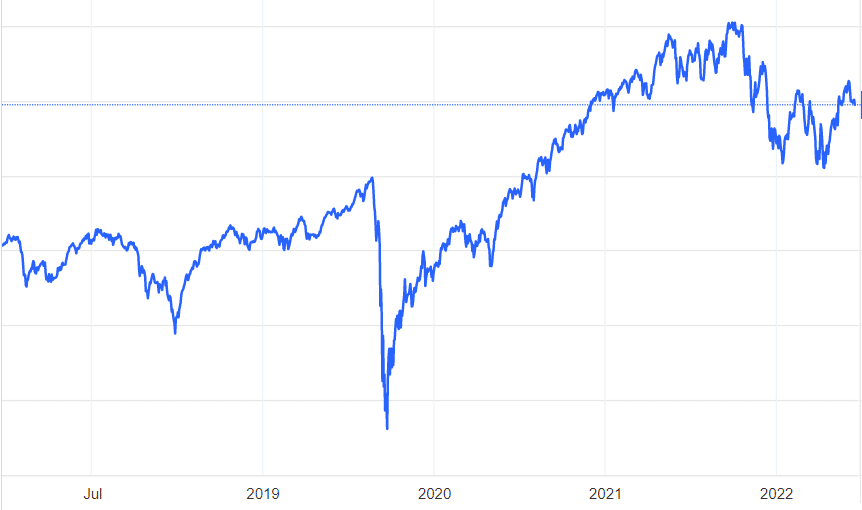

During early 2020, the emergence of COVID-19 became an international pandemic. The stock market felt the effects of the pandemic almost immediately. Lockdowns were enforced worldwide causing businesses to close their doors and issue mass layoffs. This led to major supply chain issues. Plus, a number of economic problems which were all felt in global financial markets. It’s interesting how something as simple as a virus could change so much about the world around us. On the graph below, the lowest point is dated March 23, 2020, just days after the pandemic was in full force.

In turn, world events can also have a positive impact on global markets. For instance, the dot-com bubble in the late 1990s where many people were rapidly adopting the use of Internet technology. Here, the global event would be the acceleration of technology whereby Internet users grew astronomically. The rush of activity in the market caused a rapid expansion and a quick increase in wealth for many. But it was short lived as the dot-com bubble eventually collapsed a few years later.

Related Reading: The Important Role of Central Banks

How do world events affect the stock market?

The stock market is a complex economic system that is influenced by world events. Countries’ economic growth or decline, international relations, political transitions and other external factors can impact share prices and the overall performance of the stock market.

For example, geopolitical tensions between countries can have a dramatic effect on the value of a nation’s currency. Which in turn creates ripple effects throughout the global financial system, eventually leading back to the stock market. Another example is unexpected natural disasters or outbreaks of disease that hinder economic growth and lead to instability in stock markets.

Ultimately, any external event has the potential to stir up drastic changes in both domestic and foreign markets. But the question still stands, how do world events affect the stock market exactly? Unfortunately, no one knows for sure! As Mark Hanna says in the Wolf of Wall Street, “Nobody – and I don’t care if you’re Warren Buffet or if you’re Jimmy Buffet – nobody knows if a stock is going to go up, down, sideways or in circles.” Part of the fun of investing is absorbing global trends and making an educated guess about what might happen next. The better you are at understanding how the world moves, the more likely it is you’ll make a lucrative trade.

Related Reading: Is the Longest Bull Market Over?

What events cause stocks to go up?

Generally, stocks will rise when the company releases positive earnings or when a larger economic event has investors feeling confident. For instance, if the company’s most recent earnings report has impressed investors and showed strong growth, they tend to buy more stock thereby driving the price up.

Similarly, good news in the market can cause a surge of investor enthusiasm. That effect drives share prices higher as investors seek to capitalize on potential gains. For example, an announcement of increasing consumer confidence may spark investor activity in certain industries seen as favorable for investment.

These are all normal practices within the stock market which are seen daily. So what about freak events? One recent example was GameStop. Between January 13 and 27 of 2021, the GME share price increased by 1500 percent. Prior to this event, GameStop had been on a steady decline. The aggregate assumption was the company would suffer a similar fate to Blockbuster. Short sellers in the market were betting on GameStop. On the opposing side, individuals on a Reddit forum called r/wallstreetbets conspired to purchase mass amounts of GME stocks and not sell it. This caused the stock price to increase drastically causing a squeeze on short sellers. Members of r/wallstreetbets did not have intentions of profiting (even though they did). But rather to bring down the institution of hedge funds and powerful investors. An event like this is rare, but never impossible.

What future events can affect the stock prices?

Investing in stock markets is a long-term game and subject to various external factors. To accurately predict stocks’ prices in the future, investors must be aware of events inside and outside of financial markets.

Examples of such events include global and macroeconomic changes, alterations in regulatory policies, changes to tax and interest rate systems, market trends, judgments on managerial operations or corporate strategies, sector-specific developments or novelties that might disrupt established order within an industry, or even natural disasters such as floods and earthquakes — the list goes on and on. As some significant development in any one of these elements can have a drastic effect on the stock prices in both short-term and long-term ways, keeping track of potential catalysts for such changes is essential for keen investors.

Related Reading: What are futures?

Should you buy stocks during war?

Investing in stocks during times of war can be a tricky endeavor. War tends to cause market uncertainty and instability, as entities within the markets may fear the potential losses by investing at such a time. However, it is important to remember that investments made in well-researched businesses with strong fundamentals during periods of war may pay off handsomely in the long run. Long-term investment strategies are generally favored over short-term ones in such scenarios, as stock prices will have more time to recover. The idea of investing during war time usually arises from the fact that stock prices fall as a result of political instability and low economic activity. Buying low and selling high is a tried and true investing strategy which can apply during times of war.

Related Reading: How long does a bear market last?

What are the 3 main causes of the stock market crash?

A stock market crash is caused by many factors, but the three primary causes are low wages, the proliferation of debt and a struggling agricultural sector. These conditions make it difficult for businesses to produce products for sale, leading to an increased deficit in market productivity. This has been compounded by an over-reliance on loans from large banks that could not be liquidated when the stock market crashed. By understanding these three main causes, you may be able to predict market crashes before they happen. Using your knowledge, you can make trades on the stock market that are likely to do well if the market were to crash.

The stock market crashes of recent years have been linked to the issue of low wages for many workers. When people are not paid enough, their purchasing power decreases drastically, leading to decreased demand and economic stagnation. This, combined with increasing inflation, has created an environment in which stocks have experienced losses due to investors becoming more and more cautious about where they put their money.

High levels of borrowing increase systemic risk, and when that risk comes to a head, as it did recently in 2008, investors often flee the market and stocks suffer. This poses considerable challenges to companies that are dependent on access to capital markets for financing their activities. What’s more, the volatility seen in financial markets over the past year has diminished investor confidence, leading to an uncertain future for numerous businesses and economic sectors.

Finally, struggle in the agricultural sector can indicate an incoming stock market crash. The production of food is a foundation for all other markets in many ways. After all, if we don’t have access to food, all the other things we can buy becomes unimportant in comparison. If an agricultural sector is suffering, it’s only a matter of time until the effects ripple towards other markets.

Predicting the stock market

Predicting the stock market can seem impossible, but with research and practice, anyone can learn to make smart investments. While there is certainly an element of risk involved in stock trading, having a basic knowledge of the financial markets can go a long way. You’ll need to understand how different economic events can influence stock prices, keep an eye on business fundamentals, and develop strategies that fit your goals. Subscribing to reputable financial publications and staying up-to-date on news developments are also great ways to form sound predictions. You’ll have to ask yourself, how do world events affect the stock market, and let us know what you find!

Read More: Understanding the Relationship Between Our Economy and the Stock Market