Inflation is a widely discussed topic in Canada right now. We all see the effects of inflation in our day to day lives, such as at the grocery store or at the pump. But how does inflation and the market interact? Inflation can be silent but deadly to a market, but that doesn’t mean a recession, or worse depression, is certain to arise. There have been many periods of inflation throughout history and we’re still here! But if you’re curious about how inflation and the market intertwine, and how it impacts your investment decisions, continue reading.

Table of contents

What is inflation?

First things first, what is inflation? Inflation is an increase in the price of goods and services in a particular market. In essence, it means buying things becomes more expensive. For example, a cup of coffee cost around $1.45 in 1990 but today it’s about $2.15 on average. On the contrary, deflation is the reduction in the price of goods and services.

What inflation means for the market

In any given market, inflation is normal and expected. Inflation of around 1% to 3% is a reasonable rate. Prices fluctuate at different paces too. Each market has it’s own set of limitations and opportunities which has an impact on inflation. At the moment, inflation in Canada is notably high at 6.32%. As you probably have experienced first hand, a lot of basic necessities, such as groceries and gas, are much more expensive than they were a year ago.

In theory, the amount people earn should rise with inflation too. This way, the average person can still afford their lifestyle despite rising prices. However, sometimes this doesn’t happen which is particularly true when a market isn’t functioning properly. Right now, many Canadian’s pay isn’t keeping up with inflation. But Canadians still have to pay their bills and buy food, so what does this mean? Unfortunately, it means the buying power of each individual decreases. In other words, you can afford to buy less.

Reduced purchasing power is the greatest impact of inflation on the market. When people can’t afford as much as they used to and purchasing power decreases, economic activity will decline. If economic activity declines, businesses conduct lay offs because there is less demand for products and services. When lay offs happen, people have even less purchasing power, and the cycle continues. As you can see, this is somewhat of a downward cycle which can lead to a recession, sometimes even a depression.

Types of inflation

The next question most ask is, what causes inflation? In many ways, the market affects inflation, but inflation affects the market too. This leaves us with a bit of a “chicken and egg” dilemma and it can be tricky to decipher which one comes first. Let’s take a look at the three types of inflation:

- Built-In Effect. Remember how we said above that small rates of inflation are expected? Well, when people expect something to happen, it is “built-in” to the market. Many workers will demand higher salaries to keep up with inflation which causes vendors to increase their prices too. This causes a spiral because the expectation induces inflation when it wasn’t necessarily there in the first place.

- Demand Pull Effect. When there is an increase in the supply of money and credit, demand for goods and services increases quickly. Often, a market’s production capacity cannot meet the new demand as fast as it’s growing. As a result, inflation occurs and prices increase.

- Cost-Push Effect. If costs to produce a product or service increase, the inflation ripples through the supply chain and eventually hits the consumer. This kind of inflation usually occurs when supply decreases thereby pushing up the cost.

Related Reading: The 4% Withdrawal Rule Demystified

START WORKING WITH A WEALTH MANAGER NOW

Inflation and the Market

There is no doubt that inflation and the market interact with one another, as we learned above. But what about the specific markets? The big three markets most are concerned with in Canada include the stock market, bond market and housing market. Read on to learn more about each.

Inflation and the Stock Market

Inflation means uncertainty which isn’t ideal for the stock market. A number of things could happen to public corporations, such as the need to conduct mass layoffs and sudden increases in prices to produce goods and services. With inflation comes rising interest rates which also isn’t good for publicly traded companies. Ultimately, these types of events affect the bottom line of a corporation which will be reflected in the stock price and dividend payouts.

Does that mean you should sell your stocks? Probably not. The stock market is volatile as is and even worse when you factor in inflation. In most cases, it’s best to weather the storm and see where you stand at the end. However, everyone’s circumstances are different so be sure to consult a wealth manager if you’re not sure how to move forward.

Inflation and the Bond Market

The purchasing power of a bond’s future cash flow fades with inflation. In simpler terms, a bond’s rate of return is usually fixed as opposed to variable. If a bond’s interest rate is 5%, then the holder is paid 5% regardless of what’s going on in the market. The income earned on a bond can buy less with inflation which means the purchasing power of the owner is reduced.

To dive deeper into this concept, bond holders must consider the real return vs the nominal return. The nominal return is how much money you get on your investment. The real return is the nominal return less inflation. If inflation is particularly high, investors may even experience a negative real return. Does this mean you should off load your bonds? In most cases, it’s best to hold onto them to preserve and safekeep your principal. This is because high inflation is usually a short term phenomenon, but the term of a bond could be much longer. But again, be sure to consult a wealth manager if you’re unsure.

Inflation and the Housing Market

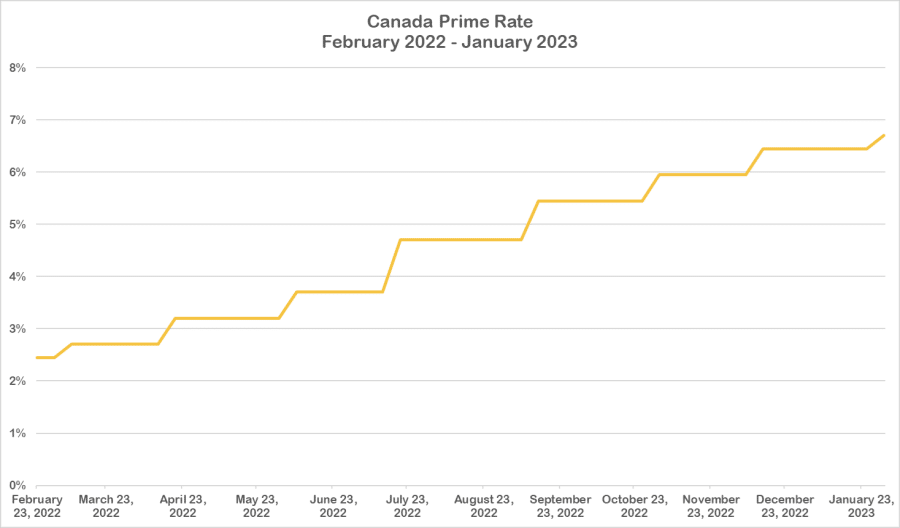

Housing and inflation are both hot topics in Canada right now, and for good reason! The biggest impact on the housing market caused by inflation is rising interest rates. In the last year and a half, Canadians experienced demand pull inflation when the prime rate was around 2.5%. That was lower than what it was in 2019; the rate then was 3.95%. Because the prime rate was so low, it was cheaper for Canadians to borrow in 2022 compared to previous years. As a result, Canadians took on more debt. But over the last year, prime rates have steadily rose, as you can see in the graph below.

When the prime rate rises, it means the cost of debt rises too. Right now, Canadians are paying more to carry their debt compared to last year. While this phenomenon applies to all debt, the most significant debt all Canadians carry is a mortgage. This means mortgage payments are inflating and putting a greater strain on finances. However, this only affects those with variable rate mortgages. If you have a fixed rate mortgage, increases in prime rates won’t affect your payment. Because mortgage payments are increasing, many are attempting to refinance to get a fixed rate. Although, refinancing is expensive to the consumer, perhaps not more expensive than variable rate mortgage payments.

A word on the possible housing bubble

Lastly, there is something to be said about the potential housing market bubble in Canada. While not directly related to inflation, the exorbitant price of housing in major Canadian cities may have been accelerated by demand-pull inflation in combination with the “fear of missing out.” There is a very real fear that consumers will miss out on wealth creation by owning Canadian property. When it became cheap to borrow, consumers flooded the housing market. This caused greater demand, which pushed up prices. However, we’re witnessing the negative effects of this now. Canadians are struggling to make their mortgage payments which could cause the potential housing bubble to burst.

Related Reading:

- A Closer Look at the State of Canada’s Housing Market – Part 1

- A Closer Look at the State of Canada’s Housing Market – Part 2

Can inflation cause a market crash?

Yes, inflation can cause a market to crash, but it is not a certainty. Although, there is a famous saying, “inflation is a silent killer.” Normally, a market crash is caused by interest rate hikes resulting from inflation. Normally, interest rate hikes are implemented to slow down economic activity. But in combination with high inflation, slowed economic activity can cause a market to crash.

What markets do well during inflation?

A market that continues to perform well during times of high inflation are good investments. At the end of the day, no one knows what the market will do tomorrow. But historically, real estate, silver and gold, commodities, and stocks tend to outperform inflation in the long run.

Seek advice when you need it

When assessing inflation and the market, it’s fair to say we’re living in volatile, uncertain times! It can be easy to panic with your investments and make a fear-driven decision. If you’re feeling overwhelmed and aren’t sure how to react to the craziness of the market, consider reaching out to a wealth manager. Two minds are better than one and it might save you from making a rash decision with your portfolio.

Read More: How do world events affect the stock market?