Canada is known for high taxes. And if you aren’t deduction-savvy? A tax bill in the thousands might come your way. But amidst home office expenses, rental payments, and tax loss harvesting lies a much more significant and effective deduction strategy: income splitting in Canada.

Imagine you or your spouse paying tax on $50,000. Now, what if you paid tax on split income — $25,000? All of a sudden, you’re in a smaller tax bracket. Income splitting in Canada is a popular tax strategy for retirement, but people can take advantage of it throughout their lives too.

Table of contents

Curious about lowering your household taxable income this year? Let’s walk you through income splitting eligibility and how to split income in Canada.

What is income splitting in Canada?

Income splitting is the process of dividing part of your income and transferring up to 50% of it to your spouse or common law partner. The idea is to lower your household income and move downward in the tax bracket hierarchy. Income splitting in Canada is completely legal and a legitimate way to reduce your tax liability.

Normally, the Canada Revenue Agency states income splitting is limited to pension income. While this is the most common income splitting Canada witnesses, married and common law partners can utilize income splitting strategies in other ways (we’ll cover this in more detail later). Let’s look at a short example below.

Say you don’t receive any pension from previous employment. You only receive Canada Pension Plan (CPP) and Old Age Security (OAS). At an average $40,000 yearly, you’re not paying much income tax and fall into the lowest tax bracket.

But your spouse has a hefty, government pension package and takes home a $101,000 salary, placing them in a higher tax bracket.

Let’s say the higher earning spouse transfers 50% of their income to you. Now, both of you are in a lower tax bracket which means you’ll pay less tax on each dollar received. Using this strategy, both your household income tax obligations dramatically decrease.

Related Reading: How Inheritance Works in Canada

Who is eligible for income splitting in Canada?

Here are the criteria you’ll need to meet to income split in Canada:

- You must be legally married or in a common-law relationship.

- If you’re in common law, you must inform the CRA within 30 days of the arrangement commencing to be recognized.

- You and your spouse must have resided in Canada together in the same home for the tax year in question.

- You received pension income eligible for income splitting.

- The spouse receiving the split must be 65 years old or older.

- You and your partner must be living together for at least one year and not separated for a period longer than 90 days.

- Exceptions for business, medical, or educational reasons that prompted a separation.

These requirements apply to the most common form of income splitting — pension income splitting. But you don’t have to be 65 to receive income splitting benefits through spousal RRSPs and loans (more on those shortly).

Next, we will dissect your income and determine its eligibility for income splitting.

What income qualifies for income splitting?

Unfortunately, you can’t split every type of income through Canada income splitting practices. Here’s what you can split:

- Registered Retirement Income Fund (RRIF) Income

- Registered Retirement Savings Plan (RRSP) Income

- Life Annuity Income

Here are a few types of income that you can’t split:

- Old Age Security (OAS) income

- Foreign pension income with a tax treaty with Canada

- RRIF amounts transferred to an RRSP, an annuity, or another RRIF (line 11500)

- Canada Pension Plan (CPP) income

- Quebec Pension Plan (QPP) income

- IRA income (US individual retirement account)

Now, what happens to your taxes after income splitting?

Tax on split income in Canada

The concept is simple. Tax on split income in Canada will be lower than if couples left their income as is. Your goal is to find the sweet spot tax bracket. In other words, the amount to split that will optimize both party’s tax brackets without going over the 50% limit. Since tax brackets are so quintessential to income splitting strategies, below is a breakdown of the 2021 federal tax brackets:

| 2021 Federal Income Tax Brackets | 2021 Federal Income Tax Rates |

| $49,020 or less | 15% |

| $49,020 to $98,040 | 20.5% |

| $98,040 to $151,978 | 26% |

| $151,978 to $216,511 | 29% |

| $216,511 or more | 33% |

As you can see, the lower your tax bracket is, the lower your tax rate is too. Income splitting allows one partner to move into a lower tax bracket, while the other party stays in the same tax bracket or moves into a higher tax bracket while both parties still pay less tax overall.

Optimizing tax through income splitting can be a tedious process. However, it’s worth it to save those tax dollars!

Related Reading: Considerations for Canadian Investors: Year-End Tax Tips

How to use income splitting in Canada

If you’re ready to start income splitting to save on taxes, keep reading. We’ll cover a few methods to do so, but each version has its own unique pros and cons. Let’s start with the most common:

1. Pension Income Splitting

Make sure you review eligibility requirements for spouses or common law partners. In addition, review income requirements for this common income splitting strategy. Here’s how to do it:

- Complete the Joint Election to Split Pension Income form

- File it with your personal taxes

Remember how we mentioned pensionable income eligible for splitting excludes OAS and CPP? You can actually apply to “share” instead of “split” CPP income with your spouse using the pension sharing form above.

But what if you want to lower taxable income without waiting until retirement? You have a couple of options with spousal loans and RRSPs.

Related Reading: Estate Planning in Canada

2. Spousal Loans

Do you worry investment income will tip your annual pay into a high bracket? Lend your profits to your spouse or common law partner at 1% interest — the latest quarterly rate set by the CRA. However, this strategy only works if you’re both Canadian citizens.

Here’s a play-by-play if you’re the higher-income spouse or common law partner:

- Sign a spousal loan agreement.

- Lend up to 50% of your income to your spouse, at the CRA-prescribed interest rate.

- Have your spouse invest the income.

- Come tax time, pay tax on dividends at your spouse’s tax bracket (lower).

- Have your spouse pay back the loan by January 30th.

- Deduct the loan and interest from your taxable income.

This is a method of splitting income without actually splitting income. Yes, there are a lot of requirements and rules, but it could save you tons on your taxes.

3. Spousal RRSPs

Spousal RRSPs allow you special privileges once you’re married or living in common law. Here’s how you can split income through Canadian investment accounts:

- Open an RRSP account for the lower-income spouse.

- If you’re the higher-income spouse, add RRSP contributions to your spouse’s RRSP.

- Max out the yearly limit.

- Withdraw RRSPs and enjoy being taxed with the lower-income spouse’s bracket.

Spousal RRSPs help you minimize taxes paid upon withdrawal. However, this strategy isn’t for the impatient couple. You’ll have to wait up to three years to withdraw or pay taxes on the higher-income spouse’s tax bracket.

4. Family Trust Income Splitting

Remember the 1% prescribed rate we mentioned for loaning to spouses or common law partners? That rate applies to family trust income splitting too. Of course, families shouldn’t have to pay exorbitant interest for their own assets. But who knew they could avoid paying taxes on them too?

A family trust entails loaning the trust money at the prescribed interest rate. The trust is responsible for paying the interest. Once deposited, the funds are set aside for the children or other family members, who’s income will likely to be low upon receiving it, thereby minimizing tax burdens for both the parents and children.

Of course, this type of income splitting requires consulting with a finance professional. It is quite a complex process. Plus, setting up a trust typically requires the support of a lawyer or finance professional. While children usually couldn’t access the funds before adulthood, it’s easy to use the funds for college, medical expenses, and other child-related costs. Not only will you be reducing your tax liability, you’ll be helping your young ones in the early days of their life. Although, this method can be used with other family members as well, including spouses and common law partners.

The best part? Tough times doesn’t mean your money is tied up. Your trust can pay you back your previously deposited funds — tax-free!

Related Reading: Trust Return Guide

Income Splitting Canada Calculator

Need help visualizing the numbers? Here are a couple of income splitting calculator options:

Both Spouses Jointly Electing to Split Eligible Pension Income

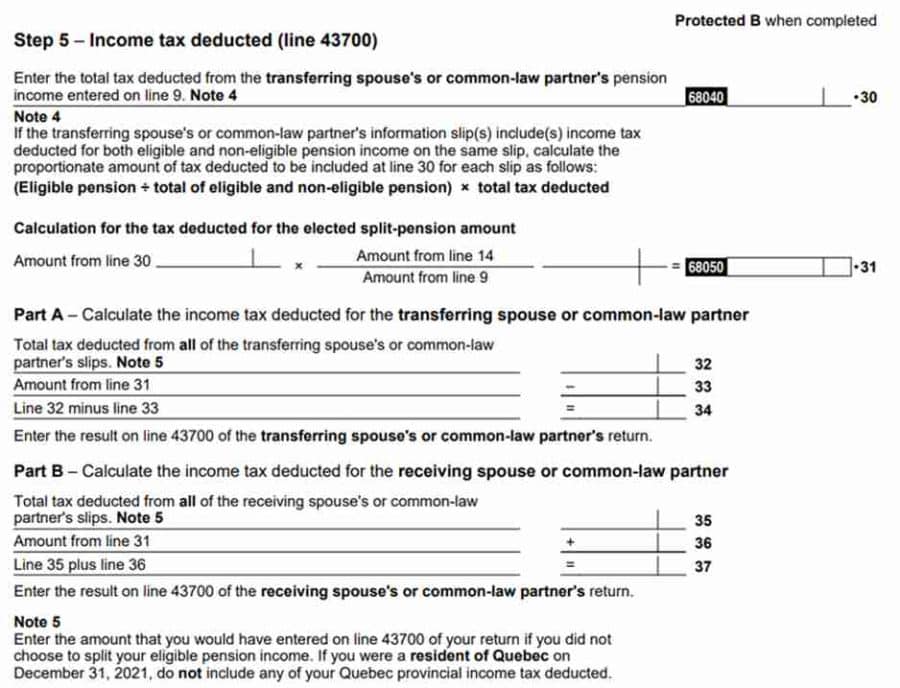

The Canadian government webpage on income splitting calculations advises you follow Step 5 of the Joint Election Form:

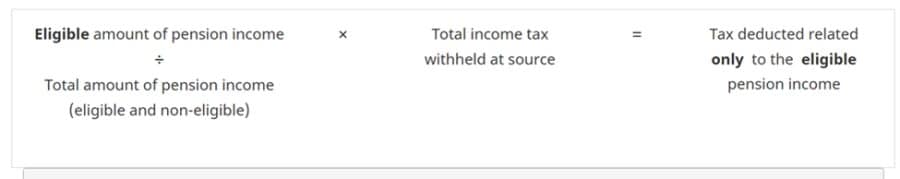

Transferring Spouse’s Information Slip includes Deducted Income Tax for Eligible and Ineligible Pension Income on the Same Slip

You can also access a free online calculator on icalculator.info.

Lowering your tax bill with income splitting

Income splitting is a detailed process, but the benefits make it a vital tax strategy, especially upon retirement. If you’re thinking about income splitting, assess all your options to pick the best tactic. Happy saving this tax season!

Read More: Best Wealth Management Books for Canadians